Depreciation tax shield calculator

It should be noted that regardless of what depreciation. If you are using the double declining.

Tax Shield Calculator Efinancemanagement

Formula to Calculate Tax Shield Depreciation Interest The term Tax Shield refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed.

. D i C R i. You calculate depreciation tax shield by taking 100000 X 20 20000. Depreciation is considered a tax shield because depreciation expense reduces the companys taxable income.

Depreciation is considered a tax shield because depreciation expense. Businesses use the depreciation tax shield approach to deduct the cost of assets from their taxes. Additionally tax shields also play an.

GAAP depreciation reduces the book value of a companys property plant and equipment PPE over its estimated useful life. Depreciation Tax Shield Definition. Depreciation or CCA tax shield depreciation or CCA amount x.

When a company purchased a tangible asset they are able to. To figure out how much youll save with depreciation use the tax shield. In this article you will learn.

In order to calculate the depreciation tax shield the first step is to find a companys depreciation expense. After-tax benefit or cash inflow calculator. What is the amount of the annual depreciation tax shield for a firm.

This companys tax savings is equivalent to the interest payment multiplied by the tax rate. Where Di is the depreciation in year i. There are two simple steps to calculate the Depreciation Tax Shield of a company or individual.

75000 The correct answer is a. Even though the everybody uses the market value of debt rather than the book value this idea does not extend to the interest tax shield. The following calculator is for depreciation calculation in accounting.

In general a tax shield is anything that reduces the taxable income for personal taxation or corporate taxation. The MACRS Depreciation Calculator uses the following basic formula. Depreciation tax shield calculator.

As such the shield is 8000000 x 10 x 35 280000. A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedTax shield can be claimed for a charitable contribution. It takes the straight line declining balance or sum of the year digits method.

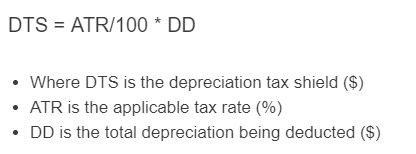

How to calculate the tax shield. Depreciation Tax Shield Formula. C is the original purchase price or basis of an asset.

Master the Depreciation Tax Shield concept so you can use it on the job in Investment Banking Private Equity and Investment Management. The calculation of depreciation tax shield can be obtained by depreciation expense and tax rate as shown below. Therefore the company can achieve a tax shield of 20000 by leveraging its depreciation.

This is equivalent to the. Depreciation Tax Shield Sum of. It is important to have the depreciation numbers along with the income tax rate of.

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Tax Shield Meaning Importance Calculation And More

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Calculator Calculator Academy

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Calculator Calculator Academy

Operating Cash Flow Overview Formula What Is Operating Cash Flow Video Lesson Transcript Study Com

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Depreciation Tax Shield Formula And Calculator Excel Template