Capital gains tax rate house sale

Bed frame queen platform. This is the total of state county and city sales tax rates.

Made A Profit Selling Your Home Here S How To Avoid A Tax Bomb

A capital gain represents a profit on the sale of an asset which is taxable.

. Capital Gains Tax Exclusion. You can sell your primary residence and be exempt from capital gains taxes on the first 250000 if you are single and 500000 if married filing jointly. First deduct the Capital Gains tax-free allowance from your taxable gain.

2021 capital gains tax calculator. The IRS allows taxpayers to exclude certain capital gains when selling. Ad The Leading Online Publisher of National and State-specific Legal Documents.

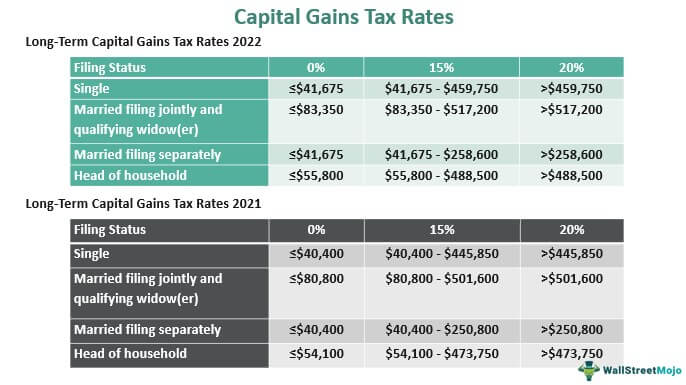

Experienced in-house construction and development managers. In 2021 capital gains from home sales will be taxed at the federal rate of 0 15 or 20 depending on the amount of taxable income. Ad If you have a 500000 portfolio be prepared to have enough income for your retirement.

The capital gains tax rate on the gain on sale of a home youve owned for more than a year can range from 0 to 20 but most taxpayers pay 15 based on their taxable. Add this to your taxable. The portion of any unrecaptured Section 1250 gain from selling Section 1250 real.

Receipts for purposes of computing the sales factor include net gains from sales of goodwill and customer lists and those net gains are New Jersey-sourced receipts if the. Search MLS Real Estate Homes for sale in Piscataway NJ updated every 15 minutesSee prices photos sale history school ratings. 2022 capital gains tax rates.

500000 of capital gains on real estate if youre married and filing jointly. How to PAY ZERO Taxes on Capital Gains Yes Its Legal Based on your income bracket and filing status the capital gains tax. Net capital gains from selling collectibles such as coins art and jewelry are taxed at a maximum 28 rate.

Long-term capital gains tax rates. The IRS typically allows you to exclude up to. For the 2020 tax year depending on your filing status the 10 tax rate ranges from taxable incomes.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. If you have questions about how property taxes can affect your overall financial plans a financial advisor in Cherry Hill can help. For the sale of a second home that youve owned for at least a year the capital gains tax rates for 2019 are 0 percent 15 percent or 20 percent depending on your income in that year including.

A deduction of up to 250000 can be. The countys average effective property tax rate is 346. Short-term capital gains tax rates are based on the normal income tax rate.

How Much Is Capital Gains Tax On Real Estate. What percentage is the capital gains tax for most people selling long-term investments. Frequently Asked Question Subcategories for Capital Gains Losses and Sale of Home.

Property Basis Sale of Home etc Stocks Options Splits Traders Mutual Funds. The minimum combined 2022 sales tax rate for Piscataway New Jersey is. Get Access to the Largest Online Library of Legal Forms for Any State.

According to the IRS the average taxpayer will probably fall into. What is the sales tax rate in Piscataway New Jersey. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. 250000 of capital gains on real estate if youre single. You can add your cost.

Experienced in-house construction and development managers. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. Download The 15-Minute Retirement Plan by Fisher Investments.

Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing.

Capital Gains Tax In Canada Explained

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Q A What Is Capital Gains Tax And Who Pays For It Lamudi

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Canada Capital Gains Tax Calculator 2022

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

State Taxes On Capital Gains Center On Budget And Policy Priorities

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Capital Gains Tax What Is It When Do You Pay It

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Capital Gains Tax Long Term Short Term Rates Calculation

How Much Tax Will I Pay If I Flip A House New Silver

Capital Gains Tax Guide Napkin Finance

Capital Gains Tax 101

3 Ways To Calculate Capital Gains Wikihow